I spent way too much money in July, some of it was explainable. It was a magical three paycheque month (if you get paid bi-weekly there are 2 months a year were you get 3 paycheques in a month). Normally my paycheques are pretty accounted for, with the first one of the month being most of my bills, credit card, cell phone, car insurance, water and electric; and then the 2nd paycheque is rent and student loan. So that third paycheque was essentially expandable, I also had several work reimbursements come through, and I got some money for my birthday. I also took a birthday trip to Thunder Bay, where I had access to a lot more things than I have in Sioux Lookout and was able to get somethings that had been on my list for months, but that I hadn’t wanted to order online and potentially not be happy with. So I spent more money than normal in July, but I have also been pondering doing a no-buy month for a bit. I like a challenge, there is something about a short-term challenge that I find very motivating and easy to stick to, easier than a long-term habit change (even though those would probably be better for my long-term lifestyle).

So I’ve decided to do a no-buy month for August 2021, this is slightly complicated by the fact that I will be buying a new car lol – but I live in a teeny-tiny remote town and the nearest Wal-Mart and Canadian Tire are over an hour away, so if I want to access most goods and services I need to drive and I quite often have to get to the airport for work and I don’t want to constantly be having to pay for taxis for that. I have gotten a taxi once in town and it was $40 for about a 6 kilometre ride, that would add up quickly.

I’ve been watching a lot of YouTube videos and reading pieces from people who have done them like this one by Olivia Muenter and this one in the Financial Diet about No-Buys and planning seems to be essential. First, figure out your absolute must expenses:

- Rent

- House bills: insurance, electric, water (that’s all I have but you may also have condo fees, security system fees, etc.)

- Car bills: insurance, payments (if you have them)

- Communications bills: internet and cell phone

- Student Loan

- Entertainment: Netflix, Amazon Prime, Spotify

- Fitness: Aubre Winters’ Sweat Sessions Online Classes (I’m actually pausing this one because I feel like I haven’t been using it as much, but I have access until the 22nd of August)

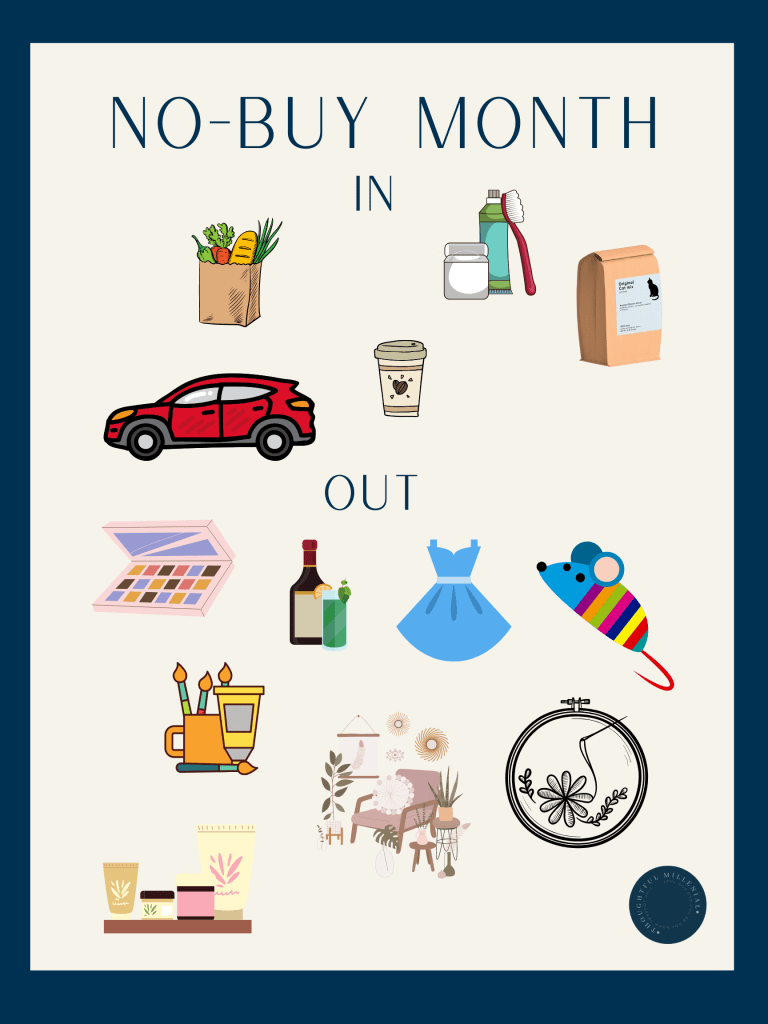

And then figure out what you need to survive/ be professional that you cannot run out of (deodorant, soap, contact solution, socks, food, medications, pet care, etc.). And make your exceptions and not allowed lists:

Things that are absolutely not allowed to be purchased during my no-buy month are:

- Makeup and skin care (the exception would be a moisturizer or sunscreen, but I have more than enough to get through the month)

- Alcohol

- Candy/fast food (although I broke this this past weekend, I bought my friend lunch to thank them for driving me to look at cars; I feel like that should be okay?)

- Clothes/shoes

- New subscriptions

- Home stuff: furniture/decor, candles, etc.

- Craft supplies

- Needlepoint stuff (including new canvases and threads)

- Cat Toys

My exceptions are basically my bare essentials:

- Groceries (I still have to eat)

- Essential toiletries (I’m going to run out of face wash this month, and you can’t stop brushing your teeth to save money)

- Car/things related to buying a new car

- Coffee – I buy myself a coffee once a week and I love it.

- Cat food and litter (my cat still needs to eat and use the litter box)

So far this has been easy, because I can’t go anywhere because I don’t have a car and had the stomach flu and those two things make it very easy to not go out and spend money or online shop. But I get paid this Friday and that is my paycheque that normally has more wiggle room and where I tend to spend more on non-essential things so next week may be harder than the past two weeks have been.

Have you ever done a no-buy month? Any tips?

Laura

One response to “No-Buy Month”

[…] So in the month of August I attempted to do a No-Buy Month. The supposed purpose of a no-buy month is to get back on track with your finances, a reset, a cleanse for your spending instead of your eating, if you will. July had been a month reckless abandon with my spending, mostly because it was a “three-paycheque” month, my birthday, and I went to Thunder Bay and ran some errands I had been wanting to for months, but when I did my monthly spending review at the end of July I freaked out a little bit. A lot, actually. So I decided to do a no-buy month for August, you can read my plan in this blog post. […]

LikeLike