So it was supposed to be a No-Spend November, and overall I did quite well. But for all my bluster about avoiding Black Friday, I succumbed. I did do what I said I would and only bought things I have been thinking about for ages or actually needed. I bought a printer, ink, and a carry-on suitcase. I also bought some peppermint pinwheel Nespresso pods and the Nespresso advent calendar, which were not needs, but I really, really do love and are making me really happy.

So overall I think this is one of best breakdowns I’ve had in a while. I’m already starting to look at new trackers for next year because I’m not in love with the one I’m currently using and I really want that one to have a chart that is needs/wants/savings/debt because there are things in bills like Spotify, Netflix, and Amazon Prime which are not needs, but also rent, electric, water, internet, phone, etc. And then in expenses I have groceries, gas, vet bills, car maintenance, but then also Sephora orders, my weekly coffee, fitness classes (which are arguably a need), and other stuff. So I always struggle with what this chart really means because it’s not like my bills are just my needs and my expenses are just my wants.

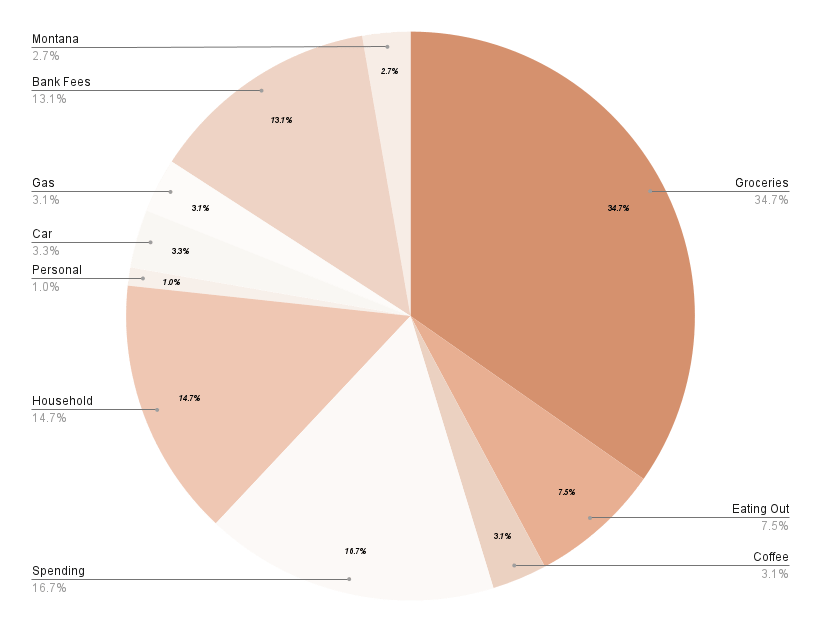

So as you can see from my expenses breakdown as usual the majority of spending was on groceries, then spending money (my suitcase, an Unfold+ subscription that I forgot about and have since cancelled, and a candle), then household supplies (bathroom cleaner, toilet paper, printer and ink, ice melt, rug pad, Command strips, light bulbs, and a new fitted sheet). I actually had perfectly budgeted for everything except the printer and ink and the drawer pulls for the dresser I refinished last summer, but I measured the distance between the holes incorrectly so I ended up returning the drawer pulls, so that is a task that I still need to complete. I don’t want to talk about the bank fees section, and then the next biggest section was eating out. I am a bit disappointed in myself, I poorly planned my grocery shop in the last week of November because I had a work trip, so I didn’t really buy anything, despite the fact that I had to feed myself all day on Monday and then breakfast on Tuesday, and I had only budgeted to eat out the nights of the work trip. I also got stuck one day when my car broke down; but that’s something that happens. I’m trying not to be mad at myself for having to use my emergency fund to pay for car repairs, because that is what emergency funds are for and that extends to things like not being prepared with a packed lunch because you are planning to go home for lunch and then not being able.

For my December budget; all my expenses are the usual except I’ve done my normal winter electric bill budget bump because I have electric heat. Which I do not recommend, it is so expensive. I have cancelled both Netflix and (insert hurt groan) Spotify. I’ve been watching Caleb Hammer’s Financial Audit videos and he always says that you don’t get subscriptions that you don’t need for work while you are in debt and I absorbed it. It will absolutely be the first subscription I get back when I’m done paying it off.

My expenses budget for this month includes:

- Groceries: $350

- Eating Out: $50

- Coffee: $40

- Trip: $900; I think this is going to be too much I got a much better deal on flights than I was expecting, I got flights home for $449 and I was honestly expecting to pay like $700. I’m also hoping to be able to buy a buddy pass from my friend instead of driving down to Thunder Bay and paying for airport parking but just in case, I have room for it.

- Clothing: $100, I have to buy tights, I realistically should have bought them in October, but I can’t wear like half my outfits until I get tights.

- Personal care and grooming: $175, I have to restock my face oil and I need some minis to be able to travel home for the holidays since I’m only taking a carry-on and I’m getting my haircut this month.

- Car Maintenance: $950; my quote is for $930, but I’m giving myself a little buffer.

- Gas: $60 (one full tank at current prices for my car).

- Gifts: $300 (I am determined to stick to my Christmas presents budget, every year I go over, but not this year).

And that’s the December spending plan. It’s unfun.

I’m already starting to think about January; I’m considering going very hardcore. We’ll see.

Laura

One response to “Financial Fitness Check-In: November 2023”

[…] Financial Fitness Check-In: November 2023. […]

LikeLike