October was baaaaad.

I knew it was going to be an expensive month. I spent a full week down in Guelph at an AirBnB (it was paid for in September), and I ate out a lot basically the entire week, got some beauty appointments done, and bought some things I wasn’t planning on buying.

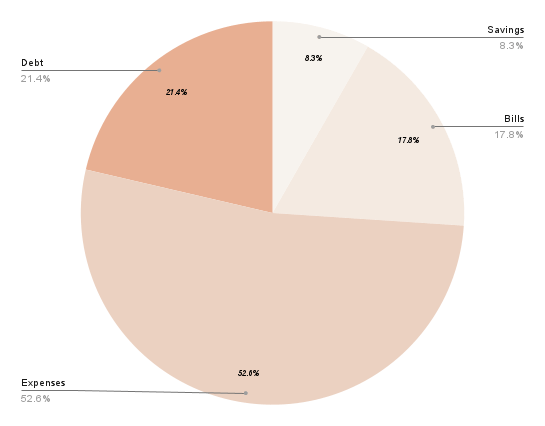

Let’s start with the bills:

Rent, internet, CAA, car insurance, Canva, and iCloud storage were all right on the money.

I was way under in water, I had overpaid (by more than double, I’m not sure why) in September, so I had a credit that is still covering some of my November bill. So I paid $0 in October. Which I love because my water bill drives me mad, I have like $8-9 in usage of water and $8-9 in usage of sewage and then like $40 each in fees and it makes me so angry every time I see the bill.

I was over in: electric by eighty-five cents, cell phone by two dollars, I subscribed to Netflix on a whim so over by $11.29. I budgeted $120 for Disney+ and it was actually $135.59. And then Spotify went up from $11.29 to $12.42.

Net I was under-budget by $80.

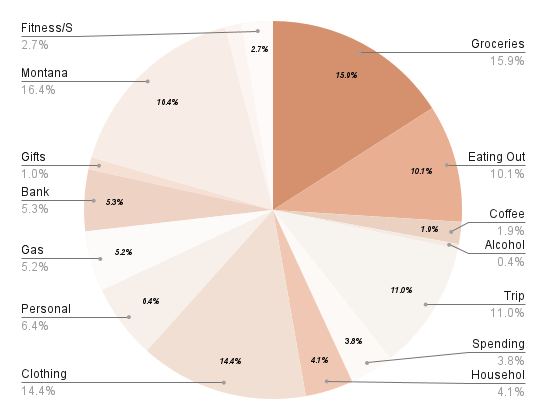

Now for expenses:

I was under-budget in: spending money (budgeted $200, spent $172.74), Gifts (budgeted $50, spent $47.44), and car maintenance (budgeted $500, spent nothing – thank you to my mechanic) and that was it. *groan*

I was over-budget in: groceries (budgeted $500, spent $729.74), eating out ($200, spent $460.26), coffee (budgeted $75, spent $86.75), alcohol (budgeted nothing, spent $18.95 – not budgeting for this when it’s the month of Halloween was foolish), tip (budgeted $400, spent $504.99), household supplies (budgeted $40, spent $187.83), clothing (budgeted nothing, spent $659.50 – I’m mad at myself about this), personal care/grooming (budgeted $100, spent $292.92), gas (budgeted $150, spent $35.98 – diesel was a lot more expensive than gas and my Dad’s car is diesel), bank fees (budgeted $200, spent $241.05), Montana (budgeted $500, spent $751.99), AAC (budgeted nothing, spent $63.21 ($45 USD)), Fitness/Sport (budgeted nothing, spent $123.71).

Okay but this graph was super interesting:

Like, yes my spending was wayyyy over my income in October, but my income was much higher than I expected (I got a raise, and it was back-dated) which made my deficit much less than I was planning for. Like it was $1200 less than I was expecting, so that was a nice thing to see.

So for November, I am expecting to get two reimbursements from work for work travel that I did in October. I was hoping to get at least one of them in October, because it’s now been about four weeks since that travel but I didn’t, the plan for the reimbursement money is to be split between my emergency fund and my moving fund.

I am also determined to truly do a full month of cash envelope budgeting and a no non-essential spending month. Although I didn’t budget anything for car maintenance for November and I’ve already bought a bottle of coolant and I snapped my snow brush/ice scraper scraping ice off my car on Monday morning and had to buy a new one. I will also probably have to buy a bottle of windshield washer fluid (people who don’t live in snowy places will be so bewildered by this section) so I really should have included like $40 in car maintenance, but I didn’t so here we are.

Have a great month!

Laura

One response to “Financial Fitness Check-In: October 2023”

[…] Financial Fitness Check-In: October 2023 (this was rough). […]

LikeLike