This is the second last month of the Year of Weddings and I CANNOT wait to be having a normal budget month. It’s only going to be November because in December I will be travelling home for the holidays, and then in January be coming back up north. So we have November and then February (I just cried a little). But c’est la vie.

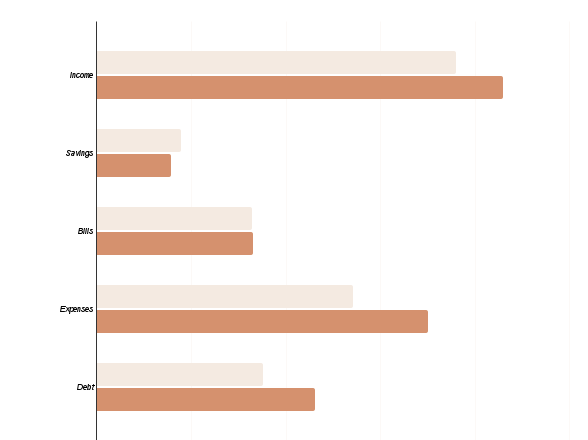

This is my planned vs. actual graph, with the lighter colour bars are planned and the darker are the actual.

I recently read or saw a TikTok about a new budget format, called 50-30-10-10, which is the classic, 50% needs, 30% wants, 10% savings, and 10% debt I think it was, I honestly cannot find it again. But I remember liking it. The problem with this chart is that not all of my bills are “needs” and not all of my expenses are “wants”. And then does my student loan payment fall into a need or a want? Like I can’t not pay it, but you technically don’t need a university education. So I’m struggling with this chart.

Okay, so this section is a mixed bag.

Groceries: I budgeted $350 and spent $309.79 – which I am so proud of! I am never this good at budgeting for groceries. I do normally budget $500, but I knew I was going to be away for a couple weeks of the month.

Eating Out: I budgeted $150 and spent $269.95.

Coffee: I am thrilled about this section, I budgeted $75 and spent $65.48. I think this was helped by the fact that I was outside of town with work for a week, then at a conference (and without a car) for a week, and then at my parents’ house/in a condo with them for a week. Said like that it maybe doesn’t sound so good, because then I basically spent like my entire budget in one week/weekend.

Alcohol: I budgeted $40 and spent $53.65. My sister got married. That’s all I have to say about that.

Trip: This is where we lost the plot completely. Because my car was not able to conduct me across the province as planned, I had to buy plane tickets home, three days before the flight. Given that, I don’t feel like the $700 and some was not that bad (especially since Air Canada was going to be over $1000 each way) and only being $400 over, when I had an unexpected $700 expense isn’t that bad. It was definitely helped by the fact that I was able to cancel a couple hotel rooms for the drive.

Spending Money: This section was so bewildering that I had to go back and go through the log to see what all happened. I spent $14.86 on an Unfold+ subscription, $9.04 for a TSN+ subscription so my Granda could watch the rugby while visiting, I spent $4 on a sticker for my suitcase. And that’s it. I budgeted $200 for spending money, and my total spend was actually $28.23.

Social: I budgeted $100 and didn’t spend a cent.

Household Supplies: Budgeted $40, spent $5. I bought a side table I am obsessed with at a yard sale the very first weekend of the month, and apparently that’s it.

Clothing: I budgeted nothing (which was FOOLISHNESS) and spent $309.56. I have no clue why I did this, I knew I needed an outfit for my sister’s wedding (and I got my dress for $59 dollars). The other was the necklace I wore to her wedding, the shoes I wore to her wedding, and the shorts I wore under the dress because it was surprisingly hot and I was worried about thigh chafe.

Personal Care and Grooming: I did a full stock-up at Sephora and got a much more expensive bang trim than my usual guy does. Budgeted $100, spent $448.73.

Car Maintenance: *cue Olivia Rodrigo screaming in All-American #itch*. I budgeted $150 for an oil change and spent $428.61 (I am trying to be grateful because it could have been so much worse).

Gas: I budgeted $200 and spent $230.70 (I had meant for this section to include my work driving, but not my vacation driving, since I did neither, I’m not sure what happened here).

And that is my September spending.

Now for October. We are 10 days in at time of writing and I still am not sure how to work this. The expensive part of the month is over (especially now that I have paid for the cat’s boarding) and I am tempted to go full hermit, full no-buy. My annual Disney+ subscription also renews on the 11th so I need to make a decision about that literally right now. I think I’m too tired for these kinds of decisions.

Thanks for reading!

Laura

One response to “Financial Fitness Check-In: September 2023”

[…] Financial Fitness Check-In: September 2023. […]

LikeLike