For some reason, I am really struggling with how to start this this month, so I’m just going to start writing and see what happens.

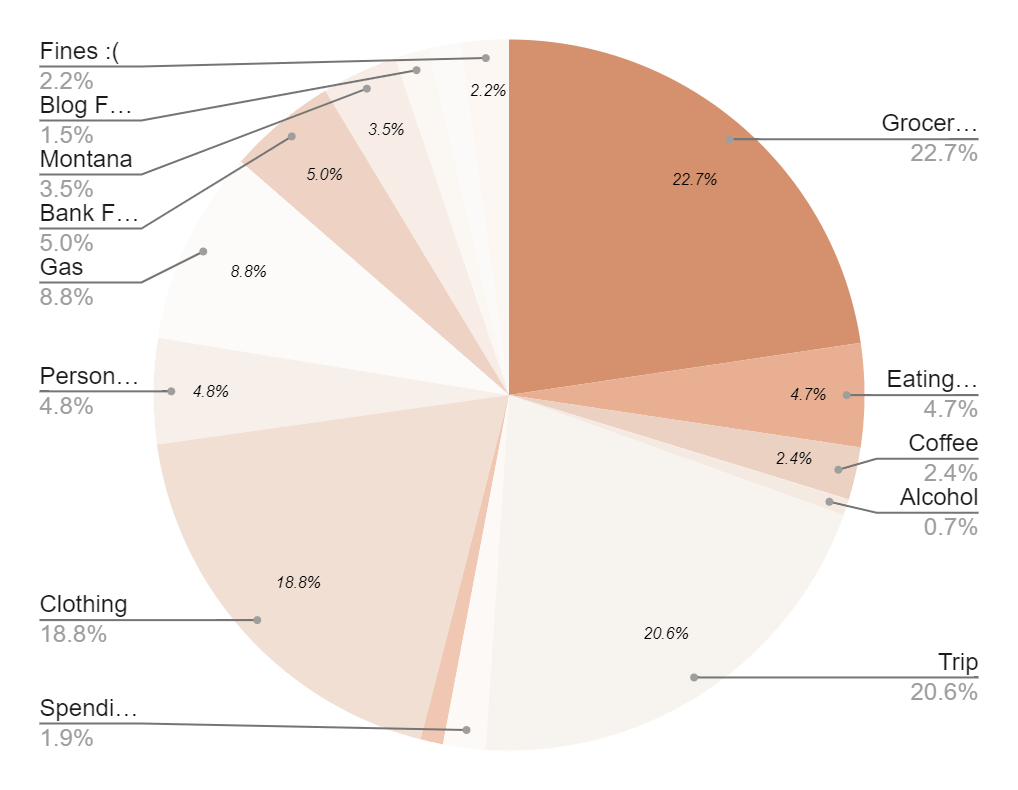

This is the overall breakdown of everywhere my money went in the month of May. This chart is very illuminating to me because I would really like to see a much smaller percent be spent and a much larger percent go towards savings. However, I am very pleased with that my bills is under 30% of my spending.

This graph is of my expenses, let’s get into it.

As per usual, my largest area of expense is groceries. However, this is my lowest grocery spend so far this year and I’m very pleased with that. Especially the decrease from April, my highest grocery spend this year, to May, my lowest. I was still very much over my budget of $500, but I am much closer.

Next biggest area was an area that I didn’t budget anything for, but should have, I knew I was going to be buying flights, and just didn’t include it. I purchased my flight from New York to London for July. So I went over-budget technically because I didn’t include it in the spreadsheet. However, in my head, I had budgeted $600 for the flight, and spent $564, so mentally it was under budget.

Next is clothing, I budgeted $500 and spent $515. I had put myself on a clothing buying ban from February to April, which may not seem like a long time, but I had gotten into a bad habit of buying like one piece of clothing a month and it was adding up and wasn’t intentional. So I’m back to being very intentional, I feel like it worked, although I also now feel like I have several holes in my closet that I am now desperate to fill. However, I did fill several gaps, I got a new swim suit, two new pairs of jeans, a top, a pair of pyjamas, all of which I have already worn multiple times and a dress that I am going to wear to two events in July.

Next is gas, this was far more than I expected to spend on gas in May, however, most of it was work driving, so it has now been reimbursed at the federal mileage reimbursement rates. I didn’t get the reimbursement until June, so it doesn’t match up on the spreadsheet. Personally, I went to Thunder Bay once and Dryden once, which is also more personal travel than normal, but it is really the work travel that got me.

My biggest regret is the personal care category, I got a Brazilian wax and I hate every single part of it. I hated the actual experience, I hated the cost, I have had a terrible reaction to it. It’s been a month and I am still a mess. I am so mad about spending this money. However, this is something that I had on my list of things that I wanted to try out before I turned 30 and at least I know now that I hate it.

Another area that was unexpected was that I either had to stop blogging or buy more storage. So I bought more storage.

For June, I know that I have to buy my flight from England to Northern Ireland and then back to Canada. I also am looking for shoes for my events in July and have found a few options on Poshmark and will re-Posh whatever doesn’t work. I also have to buy a new suitcase. The only suitcase that has ever been mine I got in twelfth grade which is now nearly 13 years ago and it has been used and abused in all my travels and moves. It no longer stands up on its own and that’s not going to work for me in my travels next month. I really want this case from Monos, but I have settled for a case from Wal-Mart.

For not knowing what to write, I sure did go on.

Here’s to a three-pay cheque month!

Laura

One response to “Financial Fitness Check-In: May ’23”

[…] Financial Fitness Check-In: May ’23. […]

LikeLike