The summer of spending money would be a very accurate description. Taylor Swift in Minneapolis in June, Phoenix, New York, London, and Ireland in July, Toronto in August. It’s not slowing down at all until mid-October, but I am actually thinking that we will be making a net return for the black in September.

But for now, August:

So, this is actually very interesting. The way I have things categorized doesn’t break down nicely into the ideal 50% necessities, 30% wants, and 20% savings and debt because in my bills I have things like Canva and streaming services which are not necessities, but also rent, electricity, water, phone, and internet (I can hear someone already saying Internet is not a necessity, but in our year of 2023 I would argue that it is). Then in expenses I have groceries, cat food and litter, gas, car maintenance, which are essentials. But also, coffee, travel, and eating out. Which are not essentials. So this is tough to line up with that ideal ratio and I should probably come up with my own that works with this graph.

This is also interesting, because you can see I was pretty on point for estimating my savings and debt pay off, but under on my income and wayyy under on my expenses.

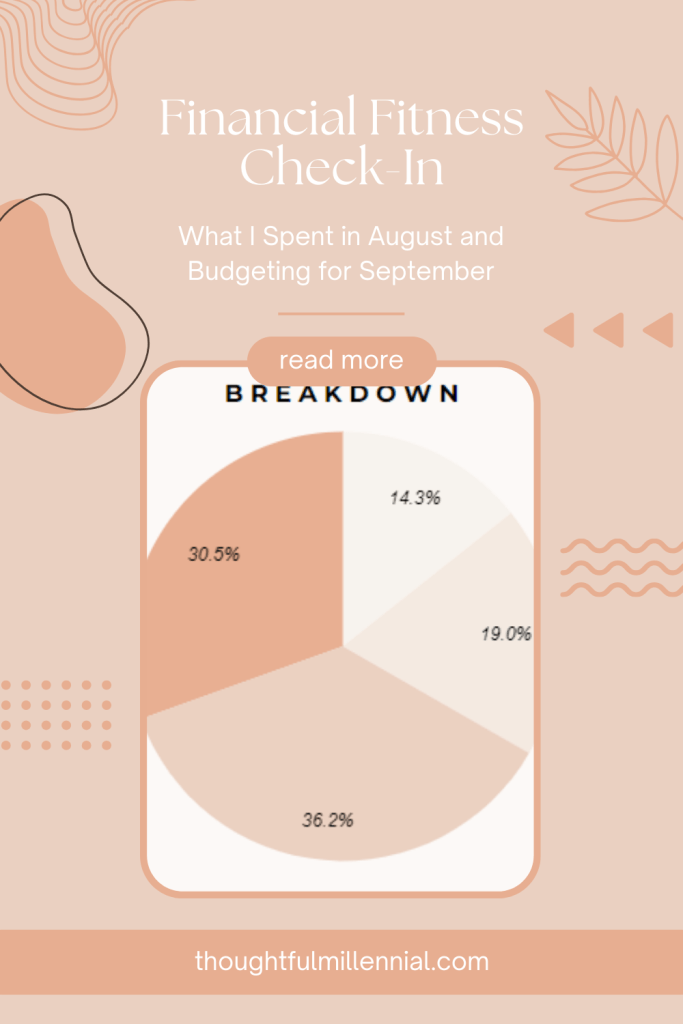

Now for the expenses breakdown for August, the eternal question: “Where did my money go?”

My biggest category this month was “Trip”, there were two contributors to this. I booked some stuff and paid some deposits for my September/October wedding trip and I went to Toronto for a wedding for a weekend. I didn’t really have a budget for myself for the weekend. I had pre-paid for my flight, so per girl maths, it was free. Which gave me flexibility to have a good time eating and hitting Pilates classes, which I do usually do when I am in a city, simply because I don’t have access to those things in my daily life. So I coded my coffee shop visits, drunk food, and Pilates class all as part of the weekend trip. (~$940)

My next biggest section was clothing, I have placed a large Abercrombie order to fill some gaps in my work wardrobe/replace some things that have gotten stained beyond repair or just really worn. I also impulse-bought a t-shirt that says “Love is a Cowboy” that I am obsessed with. I also thrifted a dress for my sister’s wedding (hopefully!) None of it has arrived yet so who knows. (~$760)

Next biggest category is groceries. I do not know what I am doing wrong. Every budget I see is like $240, $300 for one person or like $400 for two people and I literally do not understand how. Is it just because I live up north? (~$690)

Then comes my Montana category. This month was also a pricey one for him, he has not been his usual self, so he went to the vet, got new litterboxes, litter, the whole lot and then we ran out of his expensive prescription wet food. ($310)

Everything else I was basically right on target for, some categories a few dollars over, some a few dollars under. So I’m pretty pleased with those.

Budgeting for September:

I am honestly struggling with figuring out September. I am driving home for my sister’s wedding and doing some driving for work in my car this month (I’ll get reimbursed for that mileage, but still, I have to pay for the fuel first). But home is nearly 2000km away and I cannot wrap my brain around estimating that fuel cost. I also feel like I should probably get my car checked out before I do the drive, and I haven’t ever done that, so I’m not sure how to go with that either.

Also, my rent has gone up. Not much, I’m in a rent-controlled building, but still, it’s another thing I have to remember. So I think I need to play around with this a bit more. I am planning on starting cash envelope budgeting, I think that will be a post in a bit, maybe next week because I think I am currently in a position where I need to do it pay cheque by pay cheque rather than month by month.

Laura

One response to “Financial Fitness Check-In: August 2023”

[…] Financial Fitness Check-In: August 2023. […]

LikeLike